This user has no status.

This user has no status.

Member

If you live in INDIA, you need to say NO to free shipping if the seller uses DHL.

I order 3 items from tabletennis11.com with the "Free DHL Shipping". What I received was a bill of 882 INR from DHL as Customs Clearance.

Tabletennis11.com declared the items with a lower price but DHL is screwing up their business.

I have ordered previously from tt11 and shipped thru DHL and at that time the declared value was more even.

The delivery person said whatever mavbe the custom charges they are going to apply 500 INR as "Handling Charges". For me the custom duty was 104.20 INR and I do agree with the taxes thanks to the new Indian Govt. But 500 INR for Handling.... Seriously....

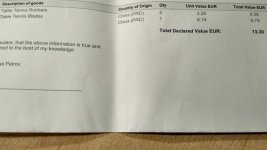

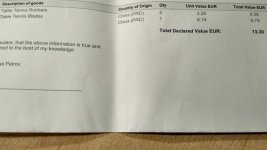

See for yourself.

Declaration of items by tt11.com

[FONT=Georgia, Times New Roman, Times, serif]Charges by DHL

[/FONT]

[/FONT]

I order 3 items from tabletennis11.com with the "Free DHL Shipping". What I received was a bill of 882 INR from DHL as Customs Clearance.

Tabletennis11.com declared the items with a lower price but DHL is screwing up their business.

I have ordered previously from tt11 and shipped thru DHL and at that time the declared value was more even.

The delivery person said whatever mavbe the custom charges they are going to apply 500 INR as "Handling Charges". For me the custom duty was 104.20 INR and I do agree with the taxes thanks to the new Indian Govt. But 500 INR for Handling.... Seriously....

See for yourself.

Declaration of items by tt11.com

[FONT=Georgia, Times New Roman, Times, serif]Charges by DHL

[/FONT]

[/FONT]